How To Find Out If You Owe A Bank Money

If you're having a hard time opening a banking concern business relationship considering of ChexSystems, follow these five steps to remove your record.

» Need more context? Learn the basics about ChexSystems

i. Request your report

Get your ChexSystems report to make up one's mind why a bank didn't approve your application. The report shows a breakdown of specific accounts closed, outstanding debts, bounced checks and more. You're eligible for a gratis copy of your written report once every 12 months.

Request your record in one of these ways:

-

Phone call ChexSystems at 800-428-9623. (This is an automatic phonation messaging system.)

-

Visit the website, go to the Request Reports section and fill out the consumer disclosure form . Submit it online or print it out and post it to Chex Systems Inc., Attn: Consumer Relations, 7805 Hudson Road, Suite 100, Woodbury, MN, 55125.

Next: 2d chance checking

Need a fresh start with your banking? Accept a expect at 2nd chance checking accounts across the U.S.

2. Dispute errors

If you notice information that yous believe is incorrect, assemble supporting documents, such as payment records or bank statements. Then go to the Dispute Information section of the ChexSystems website and choose how yous'll submit your dispute:

-

Online: At the link above, click on that webpage where it says "submit your dispute at present." You'll exist taken to a form to fill up out and an surface area where you tin upload files that support your merits. Once you're fix, hitting "submit" at the bottom of that page.

-

Via mail or fax: Starting at the same link above, click at the phrase "read more most other methods of submitting a dispute." From in that location, y'all'll meet a link for the "Asking for Investigation" course to print out. Then fill up in the necessary information and include copies of whatsoever supporting documents — non originals. Send these files to the accost listed above, or fax them to 602-659-2197.

-

By telephone: If y'all've already received a copy of your ChexSystems report, yous can speak to a representative at 800-513-7125. This is helpful if you don't have whatsoever supporting documents. Yous tin can't make disputes involving fraud or identity theft by phone.

The next part is up to yous. You can let ChexSystems contact the bank or credit union that reported false information on your behalf or mail a dispute to the financial establishment yourself. If you choose to exercise it yourself, employ this sample letter to become started.

ChexSystems and your financial institution must enquiry the dispute within 30 days. If they confirm that data is incorrect or incomplete, they're bound by federal law to correct it. If you lot're not satisfied, you tin add a brief statement to your report explaining the problem.

Citi Priority Checking

Deposits are FDIC Insured

Chinkle Spending Business relationship

Federally insured by the NCUA

Alliant Credit Matrimony Loftier-Charge per unit Checking

Axos Bank® Rewards Checking

Deposits are FDIC Insured

One Spend

three. Pay off debts

If your study is accurate and yous owe coin, pay it. If your budget is tight, ask your creditors if they'd be willing to settle for less than the debt amount.

"I was able to negotiate a payoff with one collection agency for a fiddling less than the full amount owed," says Steven Hughes, an entrepreneur in Columbia, South Carolina. He had racked up nonsufficient-funds fees in his checking business relationship, which ended upwardly getting closed.

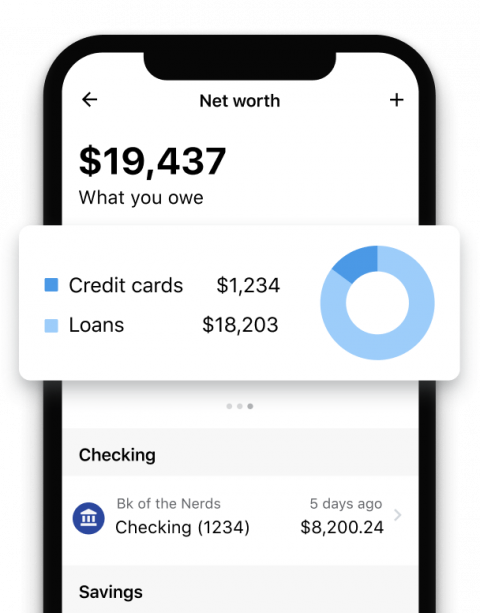

Gear up to conquer your debt?

Rail your balances and spending in 1 place to encounter your way out of debt.

4. Enquire creditors to remove information

Once you've paid your debts, inquire the collection agency or other creditor to update your file on ChexSystems. Become payoff data in writing and keep track of receipts or other documents that evidence you've paid the debt.

In Hughes' case, once he paid the agreed-upon amount, he received a receipt for payment and sent information technology to ChexSystems. "The adjacent report I pulled showed that the debt had been cleared," he says.

5. Wait until the record drops off the database

If all else fails, await until blemishes fall off your record. Reported information usually is removed from your ChexSystems file afterward 5 years.

Until then, yous might be able to open a 2d-risk checking account. These accounts are designed for people with bad credit or banking histories. Although they more often than not have monthly fees you tin can't avoid, they can help rebuild your fiscal history and make you eligible for a standard bank account, usually within a year.

If you'd rather not deal with a banking concern account right now, you could cull from our list of the best prepaid debit cards . These spending cards have some banking features such as directly deposits and multiple loading methods including cash loads and bank check deposits.

Source: https://www.nerdwallet.com/article/banking/steps-to-clear-up-your-chexsystems-record

Posted by: cummingstheplain.blogspot.com

0 Response to "How To Find Out If You Owe A Bank Money"

Post a Comment